How PE Fund Accounting Software Transforms Private Equity Management

In today’s competitive private equity (PE) landscape, precision and performance are inseparable. Fund managers are under mounting pressure to deliver transparency, maintain...

We are delighted to present the Q2 2023 edition of our newsletter, featuring a round-up of company news, product updates, and market insights from daappa HQ.

An update from our CEO Karim Ali

Read our latest industry insights - The Rise of Retailisation in Private Markets.

Learn about our Roadmap

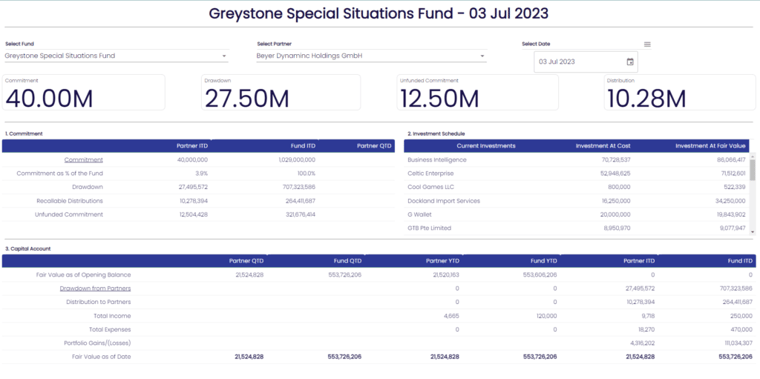

Introducing our new innovative Capital Account Statement

Read on for more details...

Welcome to our Q2 2023 quarterly bulletin, where we share exciting updates from daappa.

Our commitment to innovation and client-centric solutions remains unwavering. In Q2, we focused on enhancing our Core desktop platform with improved NAV workflow automation and equalisation features. Looking ahead, we are excited to announce upcoming enhancements for corporate funds related to carried interest, performance, and scalability, designed to optimise your operations and drive efficiency.

The upgrades to daappa Studio+ have transformed the user experience. With new analytics dashboards, an interactive capital account statement, and an extensive NAV movement analysis screen, you gain greater control and deeper insights into your operations. We are also working on further upgrades to our compliance functionality to ensure comprehensive regulatory compliance.

To coincide with the upgraded Studio+, we presented at the Adminovate conference in Ireland to key members of the Irish funds Industry. The feedback was very positive, and we believe supporting clients who choose to outsource parts of the operating model will benefit greatly from the continued work we intend to do in Studio+

Thank you for your interest in daappa. We are dedicated to delivering outstanding solutions tailored to your needs.

We look forward to the possibility of working with you and showcasing the value we bring to your organization.

Regards,

Karim Ali

CEO, daappa

The retailisation of private markets is reshaping the investment landscape, creating new opportunities for investors, asset managers and fund administrators.In this article, we will explore the driving forces behind this trend and present practical strategiesto navigate the challenges and capitalise on the benefits of retailisation…read now

daappa is excited to share with you details of our roadmap which in the near term is focused on enhancing features for corporate funds related to carried interest, compliance, performance, as well as new CRM integrations.

Our roadmap is driven by our clients and market developments to address pressing business drivers and regulatory complexities that businesses in the industry face.

Learn about what's its like to have your say in shaping the future of daappa and the market as a member of our Client Advisory Board by contacting us today.

Outsourcing back offices to third-party administrators (TPAs) cuts costs and provides access to operational expertise, but it often results in loss of data control as firms are limited to CSV or PDF formats.

Why is this problematic?

You've likely heard 'data is the new oil'. For GPs and asset managers, data is vital for understanding fund performance, identifying new investment opportunities, managing risk, and reporting to clients.

How does Studio+ solve this?

Newly released functional features, including Partner and Fund Capital Account Statement dashboards, a NAV dashboard, and a reimagined Compliance – now titled Monitoring, work in conjunction with our existing Analytics, Look Through, and Portal apps. These enhancements enable firms to aggregate, validate, and visualise their data in a more efficient and insightful manner.

Please get in touch with our sales team to see a demo

daappa Studio+ We're delighted to announce an innovative advancement at daappa - the interactive Capital Account Statement. As we navigate the era of digital transformation, we're stepping beyond the constraints of traditional static financial reports.

Revolutionise your understanding of private equity with daappa Studio+. Our dynamic dashboards transform static Capital Account Statements into powerful tools, providing real-time insights and comprehensive data. Enhance transparency, boost investor confidence, and make well-informed decisions to optimize your investment management processes. Experience the future of reporting with daappa.

Please get in touch with our sales team to see a demo

In today’s competitive private equity (PE) landscape, precision and performance are inseparable. Fund managers are under mounting pressure to deliver transparency, maintain...

.png)

Amid rising operating costs and a shortage of experienced talent in Europe’s financial services sector, daappa Ltd and OneNexus Outsourcing Services LLP announce a strategic...

With the introduction of CSSF Circular 24/856 on 1 January 2025, private market fund managers operating in Luxembourg face stricter oversight on NAV calculation errors, investment...